Benefits of Company Culture, Best Workplaces, Research

Here’s how investment banks like Jeffries are helping money managers get ahead of disruptions in the labor force — and what the trend means for your company.

Investors and fund managers are increasingly conscious of how labor relations impact company performance.

“They have been deeply studying the impacts of human capital strategies on the companies they invest in,” shared Matt Spring, senior associate on the sustainability team at global investment bank Jefferies, at the For All Summit™ hosted by Great Place To Work®. The session was part of the Executive Leadership Experience, a new addition to the annual weeklong conference.

“They are very well resourced to bring on different alternative data sets to help them answer those questions,” Spring said.

The question they are trying to answer? “How does a human capital strategy for a company impact the performance of the business?” he said. “How does it move the price of the stock?”

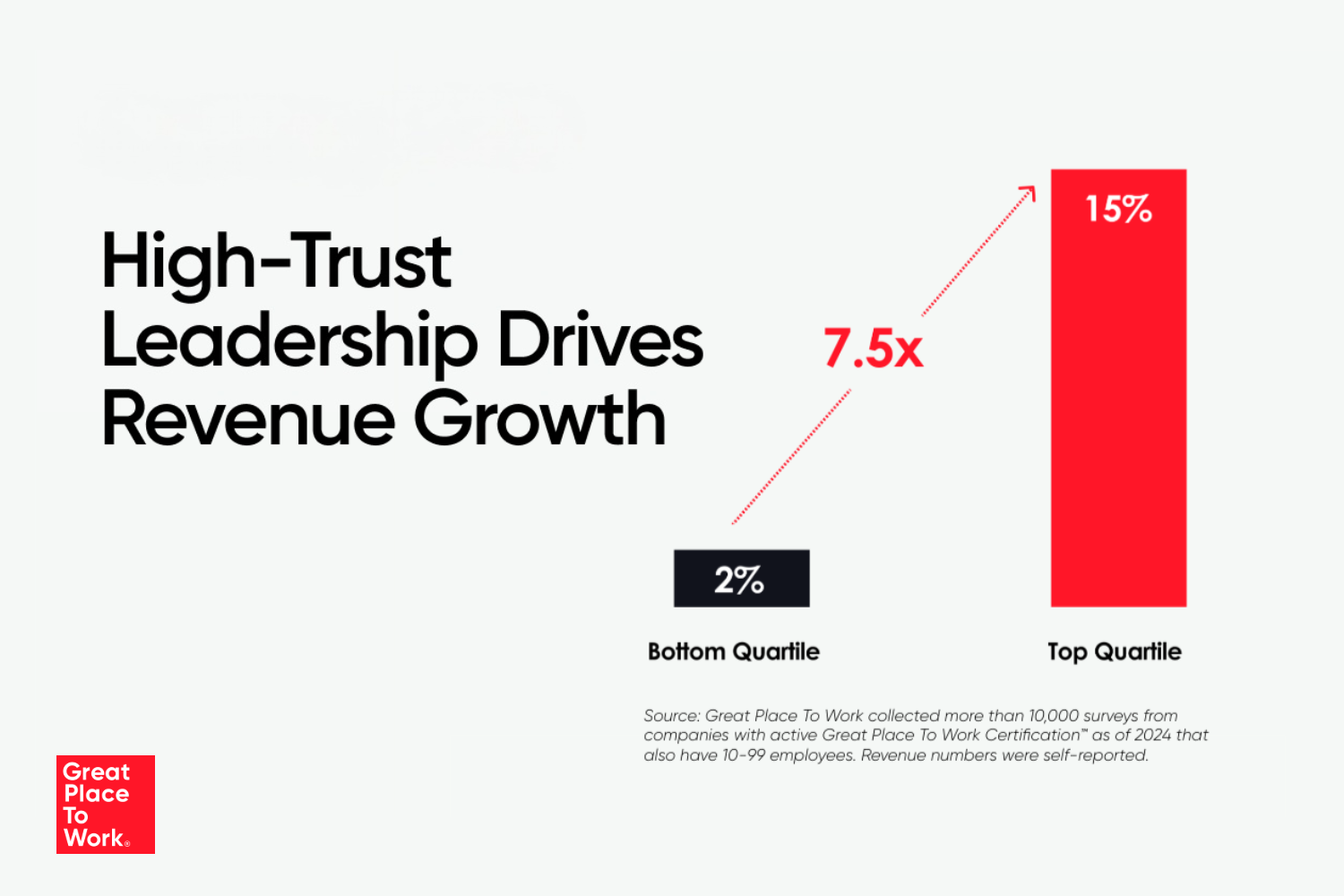

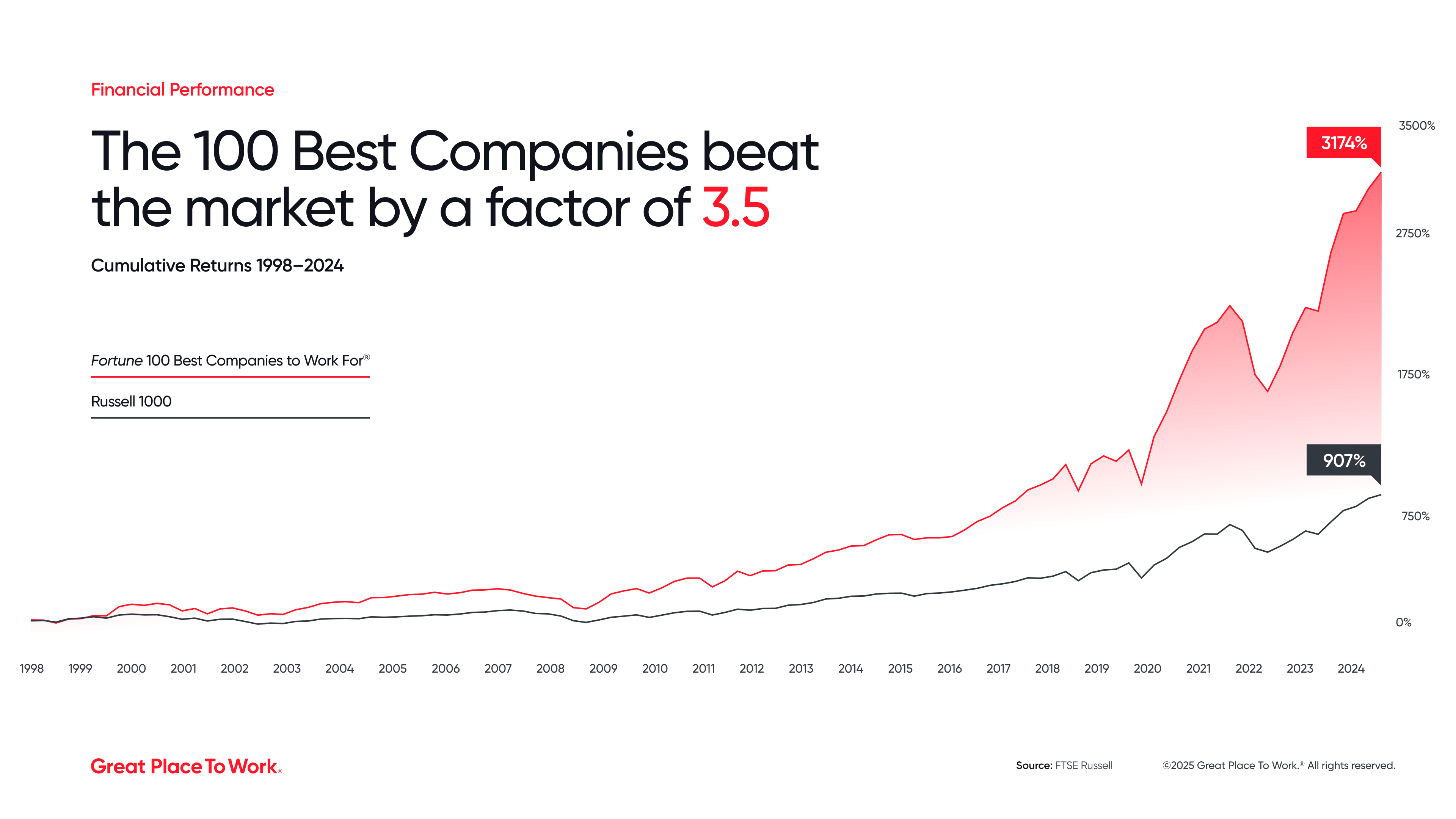

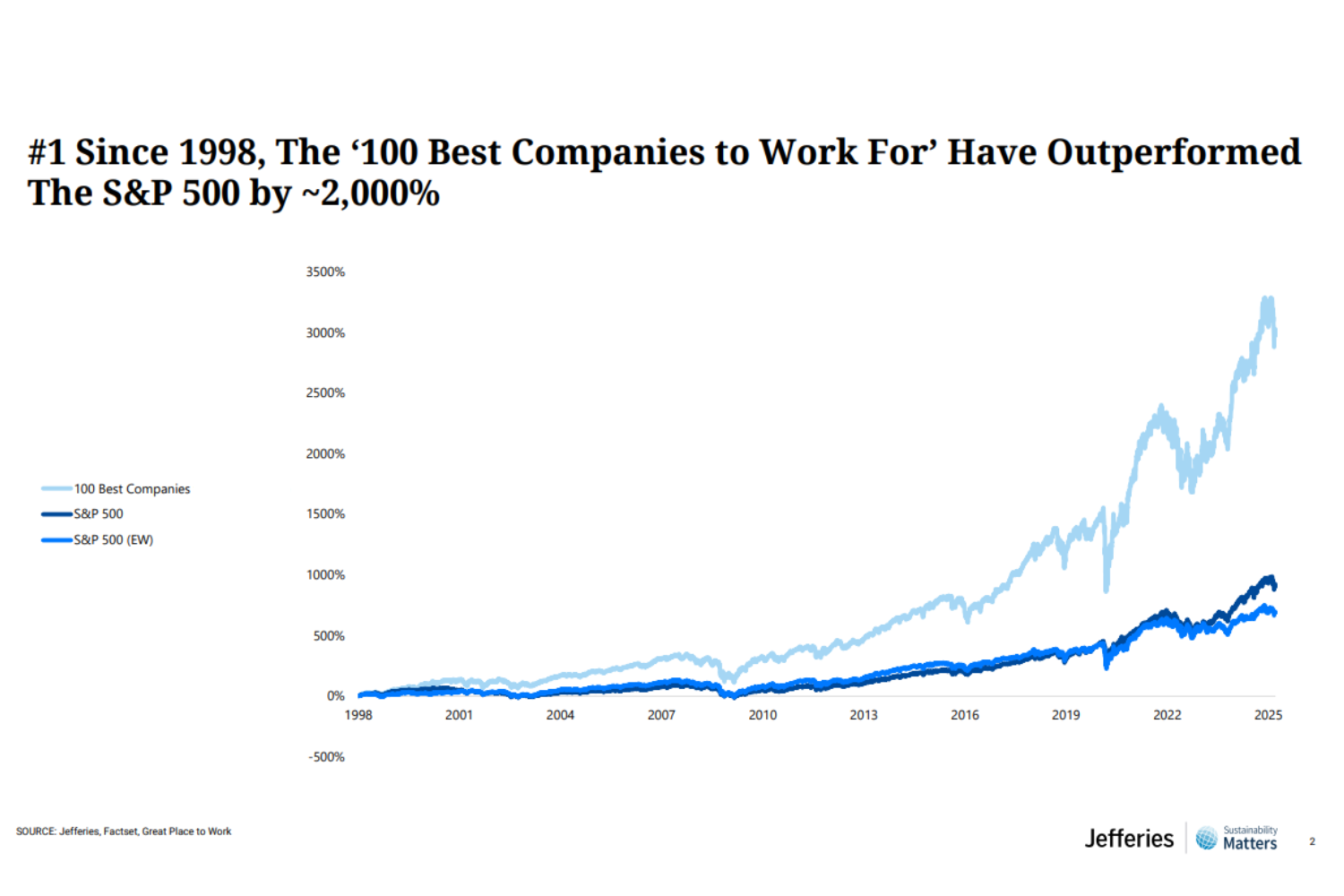

One such data set is employee experience data collected by Great Place To Work, including the list of the Fortune 100 Best Companies to Work For®. Companies on the list have outperformed the S&P since its inception in 1998.

Against an equally weighted S&P 500, the publicly traded companies on the list averaged 6% in annual returns, with the portfolio rebalanced every year to reflect the new list. Cumulatively, the 100 Best Companies outperform the S&P 500 by more than 2,000%.

“If you had outperformed the market by about 6% every year for 28 years, you would be the best investor of all time,” Spring said.

Join us for the For All Summit in 2026 in Las Vegas April 21-23.

What kind of investor cares about the employee experience?

Institutional investors like Blackstone, which manages $1 trillion in assets, are keenly aware of employee performance and regularly measure the employee experience of the companies they invest in through surveys.

“We look at employee engagement scores in all of our companies as a leading indicator of business health,” shared Courtney della Cava, Blackstone senior managing director and global head of portfolio talent & organizational performance, at the For All Summit. Along with numbers like employee attrition, engagement scores can be leading indicators of future performance.

And chief human resource officers are key to driving the transformation that earns Blackstone a return on its investments. “We absolutely focus on getting great CHROs,” della Cava said.

One such investment for Blackstone was Hilton, which it took private in July of 2007. When the hotel chain went public again in 2013, with a full exit in 2018, Blackstone made a profit of $14 billion in one of the most profitable private equity deals in history.

A key ingredient in Hilton’s rebound? It’s now No. 1 on the Fortune 100 Best Companies to Work For list.

Other investors, including CalPERs, the pension fund for public employees in California, are increasingly considering employee experience, as well as international investors, Spring said.

“We have received a lot of interest in our work from asset managers in Europe, from investors in Singapore and in Japan,” he said, “but I would say it is the U.S. institutional investor crowd that have, in particular, been thought leaders in the space.”

A hedge against volatility

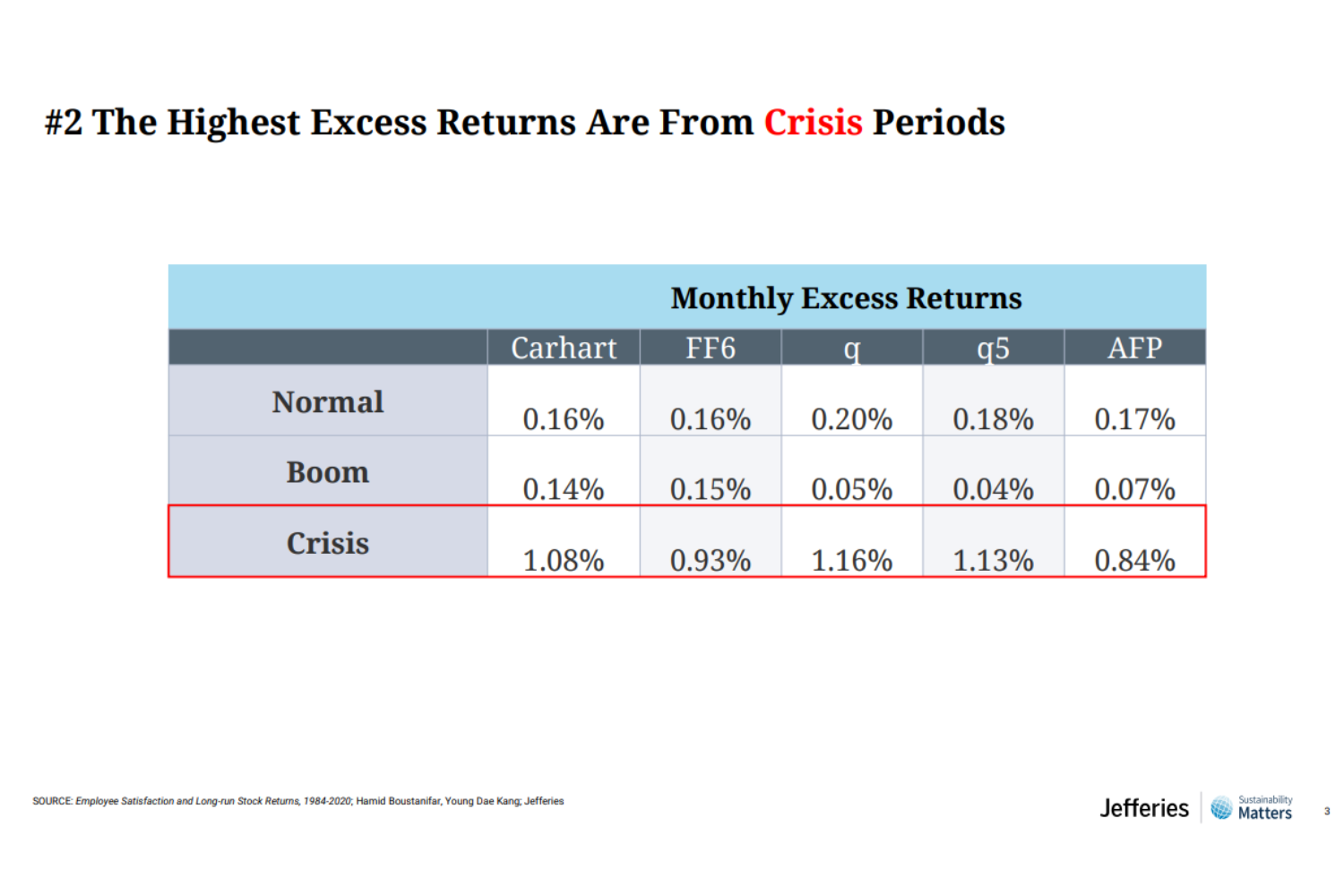

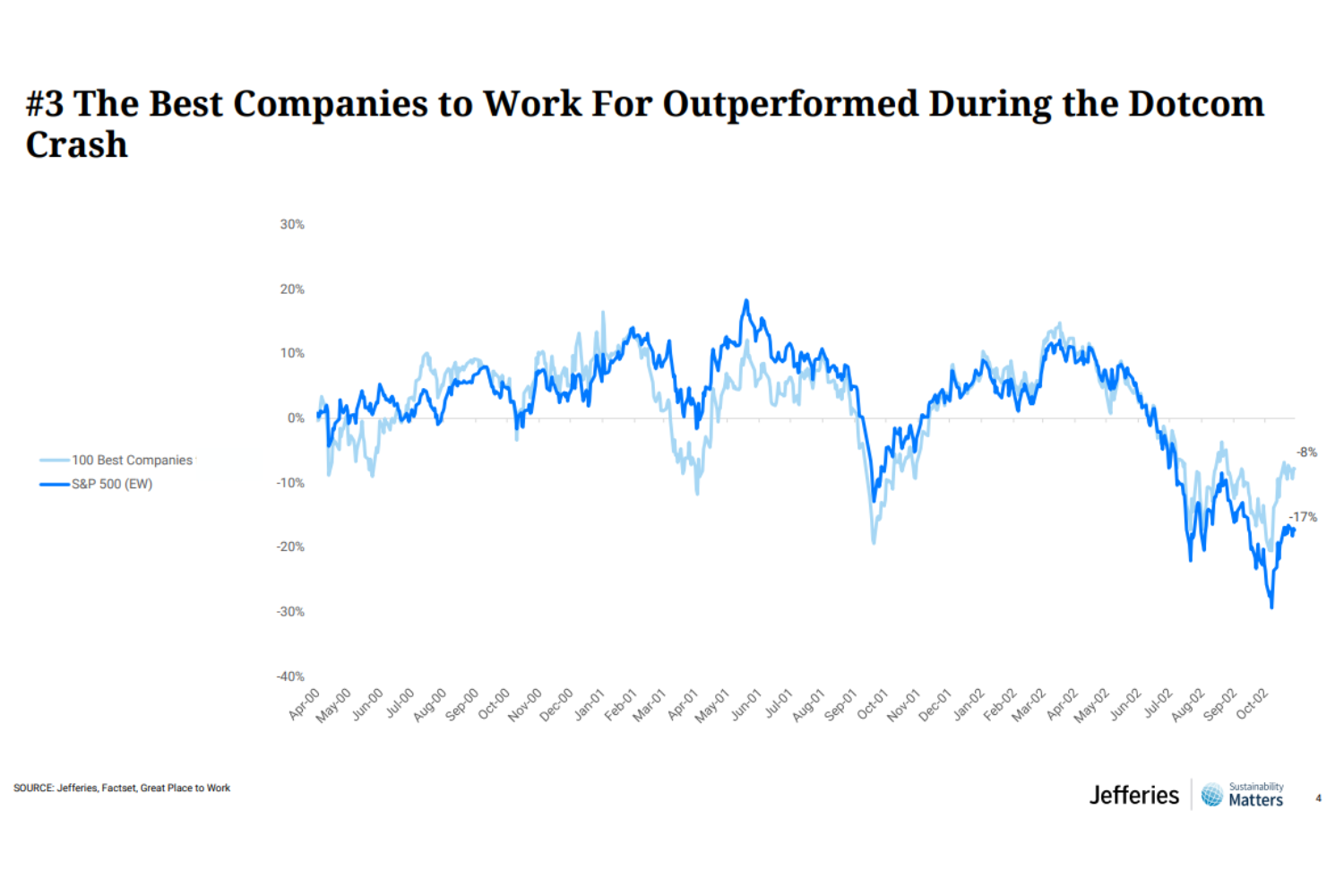

One reason investors might increasingly pay attention to workplace culture? A high-trust culture historically has outperformed during economic downturns — to the point that the most dramatic outperformance for the 100 Best occurred during crises like the dot-com crash and the 2008 financial crisis.

“I think it is the most significant takeaway,” Spring said of the work done by researchers Hamid Boustanifar and Young Dae Kang, which Jefferies was able to replicate. During these two periods of crisis, the 100 Best outperformed by nearly 1% per month on five different factor models, which control for variables like company size or industry.

The consistent historical outperformance suggests that high-trust companies like those on the 100 Best list are better situated to handle an economic shock or broader market volatility.

Does that mean the 100 Best will outperform in a recession caused by tariffs or stagflation? Spring cautions that historical analysis doesn’t predict future performance. Rather, these numbers are a guide.

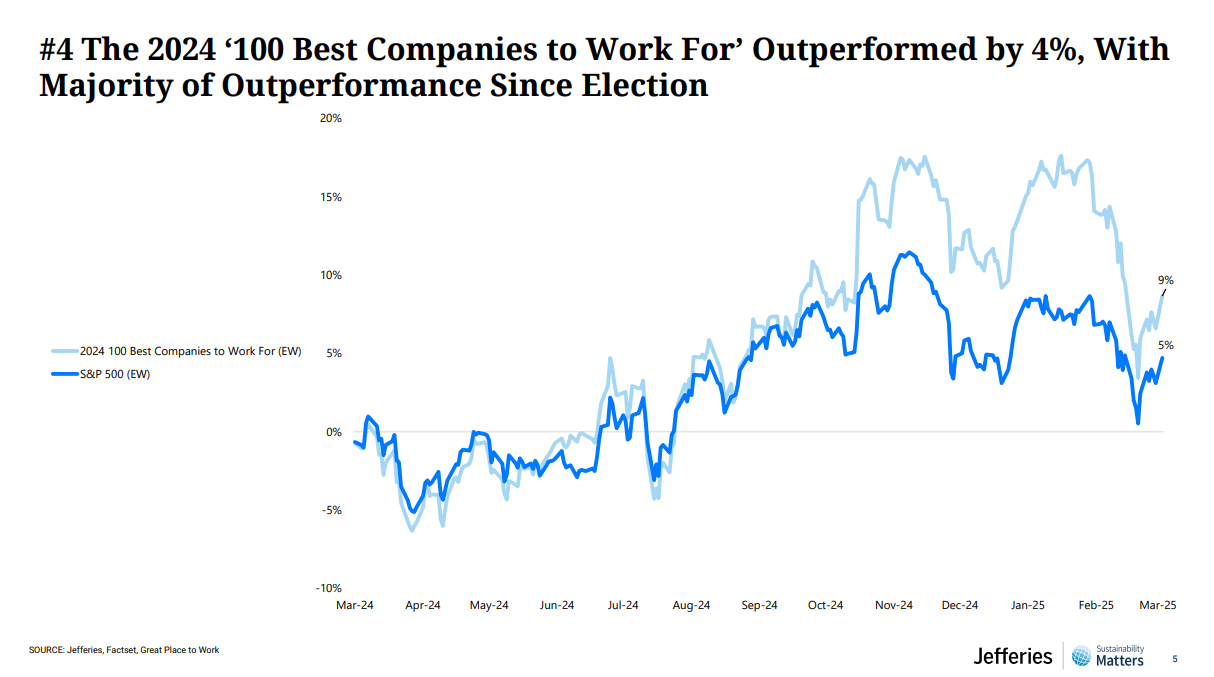

However, the 2024 100 Best winners already see higher returns, with the majority of the outperformance coming after the shockwave of the 2024 U.S. presidential election. Jefferies’ analysis stops short of the period marked by the tariff-fueled trade war launched in March, but the pattern remains the same.

The next frontier for human resources: AI

Where will investors try to find a competitive advantage going forward? It’s all about AI, according to Spring. As he shared with Summit attendees: “The central investment theme going forward for investors … is the integration of artificial intelligence into the workplace.”

So far, investors have been focused largely on the creators of AI, tech companies involved in developing the technology, and the energy companies supplying the megawatts required to power large language models at scale. Increasingly, investors are going to look for companies where AI is being used effectively and efficiently to drive value in every industry.

“There is really no structure right now for how an investor would analyze that,” Spring admitted. “I think in the next six to 12 months, as well as in the years to come, we’re going to find that institutional investors start to care deeply about how companies are investing in AI.”

That doesn’t mean that investors will demand layoffs or focus only on efficiency. “There’s a way to come at this theme where it is about uplifting the employees and increasing the productivity of the company,” Spring argued, “increasing revenues and profits, but at the same time bringing your employees with you.”

After all, companies that create a great experience for their employees have historically outperformed their competitors by over 2,000%. It’s a decent bet that those same principles apply in the AI era.

Turn culture insights into business wins

Let the Trust Index™ Survey reveal your workplace’s hidden strengths and areas for growth. Start transforming today.