Benefits of Company Culture, Company Culture, Profitability

When HR and business strategy work together, employee experience and financial outcomes both improve.

For many HR professionals, it’s an all-too common scenario: people and culture initiatives being cut due to financial constraints.

It’s understandable. When a CFO is looking primarily at the bottom line, it makes sense to cut things that don’t show a clear or immediate ROI, especially in times of struggle or uncertainty. And unfortunately, people strategies often aren’t viewed as a direct line to profit.

But this perspective is short-sighted — has shown that when employees trust the people they work for, enjoy the people they work with, and take pride in what they do, companies see better stock performance, reduced turnover, and higher productivity.

The CFO mindset: Why HR needs a new narrative

“People and culture are often seen as ‘soft’ things or luxuries that are nice to have,” says Matt Bush, principal, global client services at Great Place To Work. “But if you’re trying to generate buy-in, they can’t remain branded as HR and culture initiatives. They need to be branded as business initiatives.”

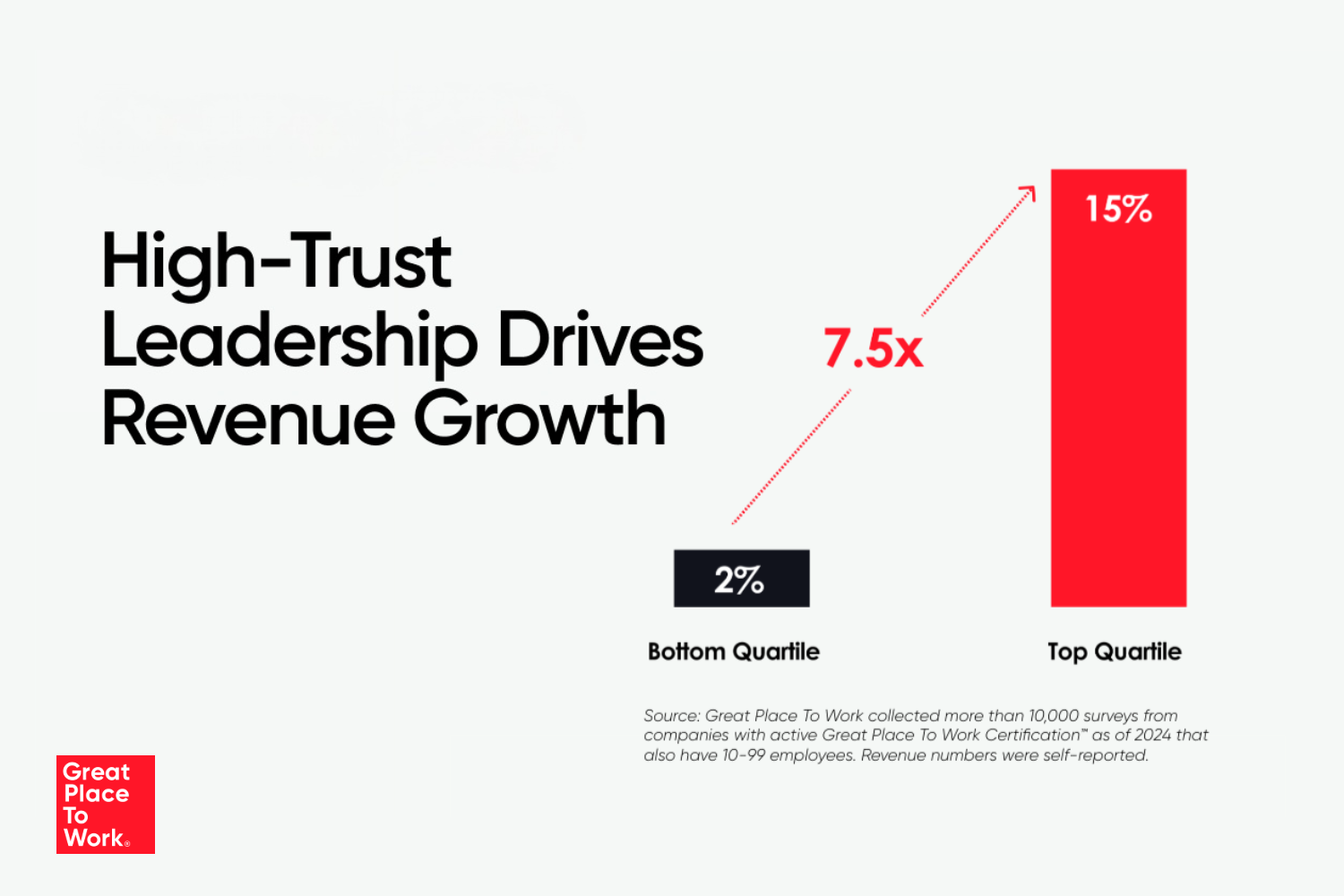

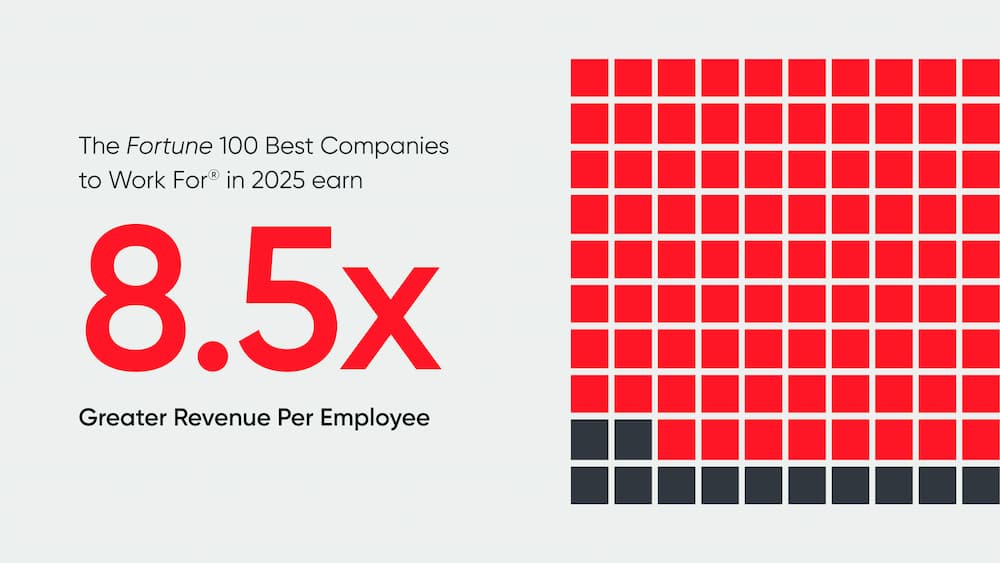

The best way to rewrite this narrative? Point to existing research that shows the correlation between people initiatives and business outcomes:

- The 2025 Fortune 100 Best Companies to Work For® have 8.5x the revenue per employee (RPE) compared to the U.S. public market RPE

- High-trust companies see better stock returns and beat the market average by 3.5x

- Eight in 10 (85%) of employees at great workplaces report giving extra effort at their job — compared to just 60% at a typical workplace

- Employees in high-trust workplaces are 4x more likely to stay, thereby reducing turnover costs, which can average $4,700 per new hire, according to the Society for Human Resource Management

“This research shows that these things aren’t just good for people — they’re also good for business,” says Matt. “If you’re a bottom-line person, RPE is about as bottom-line as it gets when it comes to your employees having a high-trust experience.”

Lessons from The Breakers: How to build trust with finance

At The Breakers hotel in Palm Beach, Florida, Denise Bober, senior vice president & chief human resources officer, jokes that the CFO is her “best friend at work” — a sentiment “not often shared between HR and finance.”

“They can’t remain branded as HR and culture initiatives. They need to be branded as business initiatives.”

But by establishing a strong relationship between both sides of the business, The Breakers has achieved milestones like having a 90% retention rate in an industry typically known for high turnover and low employee engagement.

“Typically, CHROs have to prove an ROI to get something done within an organization,” says Denise. “But we’re fortunate that’s not the case — we’ve been able to collaborate and come together to build success for our team.”

One way they’ve achieved this is by embedding finance in the process, with the CFO on HR initiatives. For example, in 2015, the HR team worked closely with the CFO to conduct a living wage study to ensure hourly team members were being fairly compensated. This type of early collaboration ensures alignment from the start and avoids the need for retroactive justification.

The Breakers also relies heavily on both qualitative (employee comments) and quantitative (survey scores, participation rates, retention metrics) data to shape and justify programs. Leadership is held accountable for action plans based on , reinforcing a culture of data-driven continuous improvement.

How to start reframing your strategy

The shift from cost center to growth driver doesn't happen overnight, but with the right approach, you can build a compelling case that speaks the CFO’s language.

Get your metrics

Proving a financial case for culture is all about having the right data to back it up. Consider:

- Signals of business impact from employee feedback: While metrics like eNPS are commonly used in HR, they’re often seen by CFOs as disconnected from business and financial outcomes. Instead, consider surfacing employee feedback that reflects outcomes CFOs care about — such as productivity, agility, retention, and customer satisfaction. These areas can be measured through the Trust Index™ Survey, and they provide a clearer link to cost savings and revenue growth.

- Turnover risk: How many employees are thinking of walking out the door?

- Turnover costs: How much does it cost your company every time an employee voluntarily leaves and requires replacement?

- Benefits utilization rate: How many employees are using the benefits you’ve invested in?

- Promotion timelines: Are employees growing within the company and becoming leaders, and how does that correlate to productivity numbers?

“Those are the metrics you should start tracking to make your business case for why these things you’re suggesting can have a positive impact,” says Matt.

“Or, if you’re not able to get those off the ground, leverage the research that places like Great Place To Work have, where we’ve used real data from the best workplaces to show how people and culture have driven performance.”

Create a partnership

Business objectives and culture objectives aren’t competing interests. Instead, present them as a partnership where every party has a sense of ownership over the strategic interests of the business.

“When HR proposes things, it should be evident that it’s informed by the direction of the business — it’s not an out-of-left-field thing,” says Matt.

“When that’s done well, that’s what feels like a true partnership. You’re trying to achieve the same things, and here’s how people and culture play a role. I think that it’s oftentimes seen as a zero-sum game.”

Zoom out instead of in

HR leaders can help CFOs to “zoom out” from short-term ROI thinking by presenting the long-term impact.

Mosaic Consulting Group implemented a data-driven culture strategy that led to a $2 million annual savings in turnover costs. By tying Trust Index scores to retention, revenue, and client satisfaction, Mosaic was able to demonstrate clear ROI on its people investments. Their leadership development efforts also boosted trust in management from 55% to 82%, and client satisfaction rose from 50% to 70%.

“So many CFOs that I’ve encountered over the years are zooming in,” says Denise from The Breakers. “When healthcare costs went up, those CFOs said, ‘No, we’re pulling that.’ That’s zooming in. It’s not zooming out.”

She recommends using data from the Trust Index Survey, retention rates, and engagement metrics to show CFOs how small, people-focused initiatives drive a bigger picture.

“Give them the big data, the big nuggets, and say those small programs are the reason why. It’s the little incremental stuff that gives you the big results.”

Remind them that leaders set the trends

Even if you already have some people initiatives in place, remind your CFO it’s not a one-and-done effort. By continuously investing in people and culture, you are future-proofing your business.

“Forward-thinking l don’t rest on their laurels,” says Matt. “They make sure to stay ahead of the trends to the point where they are setting the trends and setting the pace.”

For example, AI is changing workplaces rapidly and unpredictably, which means employees’ needs and challenges will also change.

“If you don’t want to risk falling behind, you have to keep listening to them. Something that was successful today might not work tomorrow,” says Matt.

From competition to collaboration

The question isn’t whether your organization can afford to invest in people and culture. It’s whether you can afford not to.

In an era where talent is your competitive advantage and employee expectations continue to evolve, companies that invest in their people won’t just create better workplaces — they’ll create better business outcomes.

Transform culture into business success

Let our Great Place To Work® Model guide your culture to drive performance. Start your journey with Great Place To Work today.