Benefits, Best Workplaces, Employee Well-being

How the best companies invest in the financial stability of their people — and how you can do the same.

As news of layoffs and rising inflation dominates headlines, the best employers are focusing on financial wellness.

Financial wellness, or an employees’ comfort and adeptness in handling their finances, has become a key part of the puzzle for helping employees thrive in 2025. One of the five key dimensions of well-being, financial health is having an impact on the employee experience — and therefore, an impact on your business performance.

Over half (56%) of full-time U.S. employees are stressed about their finances, per a 2022 survey from PwC. Thirty-four precent said financial stress had a major impact on their mental health and 18% reported that it affected their productivity on the job.

Companies invest in financial well-being programs with the hope that their efforts will improve employee morale, productivity, and performance while reducing absenteeism, health care costs, and mental health strain.

With recession fears on the rise, employees are looking more closely than ever at their finances. Here’s how some of the best employers in the country are helping their people build a strong financial foundation:

1. Pay increases

In a challenging economy, fair pay is a baseline requirement for a healthy workforce.

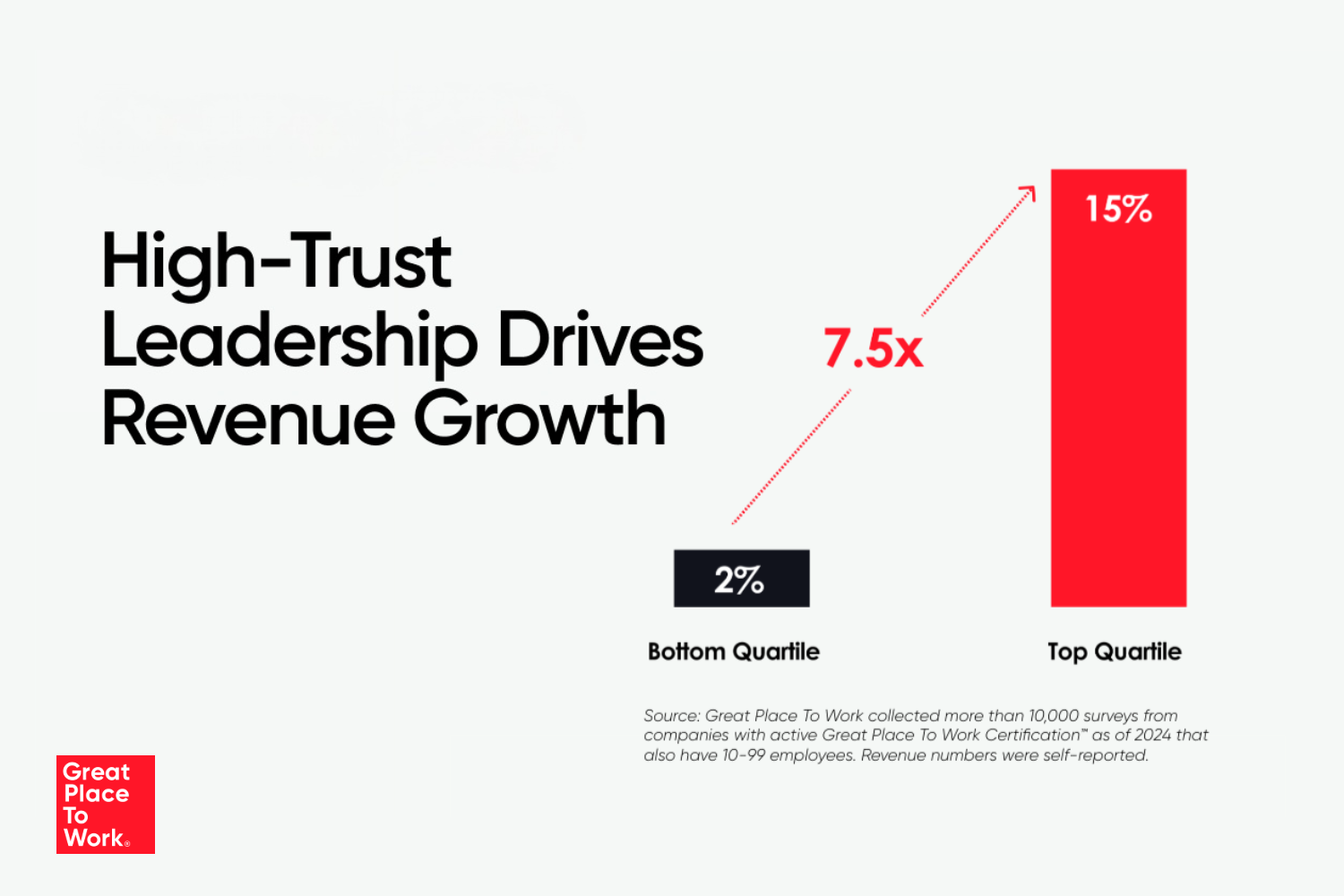

For hourly workers, fair pay is a top concern when thinking about how to improve their experience at work. Fair pay is also closely linked with whether employees say they trust their employer.

To combat inflation and help employees support their families, many employers are raising wages.

Construction firm Hilti, No. 86 on the 2023 Fortune 100 Best Companies to Work For® List, gave an additional merit increase on top of its traditional annual increase. Scripps Health, a nonprofit healthcare provider and No. 95 on the 100 Best list, increased salaries by 10% overall in 2022, compared to an average of 4.5% in the prior three years.

Companies with hourly workers focused on raising their minimum wage. Bank of America, No. 63 on the 100 Best list, raised its minimum wage in 2022 to $22 an hour, part of its effort to reach a minimum hourly wage of $25 an hour by 2025.

2. Hardship grants

Sixty-three percent of Americans are living paycheck to paycheck. For these workers, a hospital bill, a family emergency, or some other unpredicted expense can create immense strain on their finances and mental health.

That’s why some employers offer hardship grants designed to help employees navigate extenuating circumstances. Global hospitality brand Hyatt, No. 76 on the 100 Best list, created the Hyatt Care Fund in 2020 to help support employees affected by natural disasters, humanitarian crises, and other unexpected events. All donations to the fund are used to support immediate and critical colleague needs such as housing payments, groceries, childcare assistance, utilities, and other expenses.

For NuStar Energy, No. 96 on the 100 Best list, the SAFE Fund Program offers hardship grants of up to $10,000 that are open to all employees and never have to be repaid. A $4,000 grant was awarded to one employee who incurred expensive veterinarian bills when his dog was sick. A $1,500 grant was given to another employee when her son’s home was burglarized and their Christmas gifts were stolen. Grants have also been awarded to employees struggling to pay out-of-pocket medical expenses and property taxes.

3. Interest free loans

With so many American workers facing personal debt crises, some employers are making an effort to help workers avoid costly, high-interest loans.

World Wide Technology, No. 19 on the 100 Best list, offers workers a program called “Purchasing Power,” which allows employees to buy items like refrigerators, TVs, computers, and more through a payroll deduction over 12 months, avoiding interest and fees. The program allows employees who do not have access to savings to replace costly items without resorting to more credit card debt or rent-to-own fees.

4. Peer support programs

Some employers are also working to make it easier for employees to support colleagues who need extra help. Whether or not you feel supported by your colleagues has a big impact on your perception of fairness within the organization.

Scripps Health created its HOPE Fund (Helping Our Peers in Emergencies) to help staff offer their own PTO or other financial assistance to employees in need. Staff can donate PTO and contribute financially through payroll deductions. From June 2021 through June 2022, 25 employees received more than $45,000 and 26 employees received 1,788 hours of PTO through the program.

5. Financial education programming

One potential risk for the financial well-being of U.S. workers is the lack of financial literacy across the population. One in three Americans are not considered financially literate – and employers can help.

Global consulting firm Protiviti, No. 25 on the 100 Best list, offers its employees financial webinars. Topics covered in 2022 included:

- Identifying and prioritizing savings goals

- Understanding and maximizing your 401(k) plan

- College savings options and financial aid guidance

- Getting your debt in order

6. College help

Many employers are reacting to the rising cost of college and its impact on their employees. The types of financial wellness programs offered to help employees with college and associated costs fit into three buckets:

- Student debt tools. KPMG, No. 38 on the 100 Best list, offers access to refinancing for loans for current students, graduates, and parents through a partnership with Citizens Student Lending.

- College advisors. KPMG also offers employees with college-bound children (age 14+) access to Bright Horizons College Coach®. At no cost to employees, this benefit provides access to a team of college admissions who can help navigate the admissions process and finance experts who can help plan for college costs.

- Tuition awards. Bicycle manufacturer Trek, No. 94 on the 100 Best list, offers an Educational Assistance Program which reimburses full-time employees for 75% of tuition-related expenses, up to $15,000 per year and a maximum of $30,000. The company has paid over $1.65 million in tuition reimbursement since 2006. Trek also offers scholarships, which college-bound children of Trek employees can apply for. From 2019 to 2021, Trek awarded $971,000 in scholarships, helping 119 students and their families.

7. Cash awards

Rather than identifying every type of issue that might affect their employees, some employers are simply offering their workers cash grants and letting individual employees decide where to spend it.

At Kimley-Horn, No. 28 on the 100 Best list, employees receive gift cards or cash in what the company calls “Red Envelope Days.” In the past twelve months, the professional services firm had four Red Envelope Days, including one in May, where every employee received a $500 gift card, and a Thanksgiving special in November, where every employee received $75 to put toward a Thanksgiving dinner (or to pay it forward to someone in need in their community).

Since 2020, employees also received three $450 funding cycles through Kimley-Horn’s My Way Dollars program, which employees can use toward the things that matter to them, from vacations, to student loans, to mortgage payments.

Additionally, in 2022, Kimley-Horn sought to help ease the burdens of inflation by providing monthly $300 deposits to eligible employees in the form of their “Inflation Busters” program. In total, employees received $1,500. Employees were not told how to spend the money; they were just encouraged to use it to help themselves and their families.

8. Transparent communication from the CEO

Employers know that their workers are more concerned about the economy and what a potential recession means for their job. Leaders are reading the same news stories about layoffs and budget cuts.

To ease employee fears, some leaders are doubling down on timely, transparent communication about the state of the business and what employees can expect in the year ahead.

At Ally Financial, No. 71 on the 100 Best list, the executive leadership team, led by CEO Jeffrey Brown, make it a point to speak directly to employees. They address not just the current economic environment and what it means for the company, but also explain why this is unfolding, what employees should be prepared for, and why it’s important for them to relentlessly focus on serving customers.

Transparent communication about the state of the business is one of the easiest ways companies can improve the financial acumen and security of their employees. It doesn’t require launching a new benefit, or allocating additional budget dollars. It just means having a candid conversation with employees about what this market means for them and how they can help the company succeed.

9. Employee discounts

For many employers, offering a meaningful employee discount is another way to help workers deal with rising inflation and economic pressure.

Retail chain Target, No. 26 on the 100 Best list, provides a 10% discount at all Target stores and on Target.com to all team members, their spouse or domestic partner, and eligible dependents. Team members get an additional 20% discount on many fitness and wellness products, such as fresh and frozen fruits and vegetables, Good & Gather organic products, All in Motion athletic apparel, and Up & Up tobacco-cessation products.

Camden Property Trust, No. 33 on the 100 Best list, a multifamily real estate investment trust, offers team members a monthly rental discount at Camden communities, 20% for regular full-time employees and 10% for part-time employees.

10. Mental health resources

Many employers are thinking about financial well-being and mental health at the same time. By supporting financial wellness, program advocates are hoping to reduce anxiety and mental health concerns caused by financial insecurity.

For some employers, that means financial wellness demands investment in mental health resources for workers.

Power Home Remodeling, No. 13 on the 100 Best list, uses its Employee Assistance Services program to offer unlimited access to assist in finding mental health professionals, legal services, and financial advisors. Employees can also take forty hours of sick time outside their traditional PTO to focus on their wellness, including doctors’ appointments, caring for a family member, therapy, or just taking a personal day. Power Home Remodeling saw a 33% increase in employees using this wellness time in 2022 compared to 2021, when employees were required to use their regular PTO bank for wellness needs.

Learn what your workers need

It’s important to survey your workforce to learn about their specific needs and how you can improve their financial well-being. Our survey tools can help.